Transitional Provisions for the 15 Per Cent NRST Rate If land is conveyed to a foreign entity or taxable trustee other than the purchaser or assignee (and their spouses), even as a result of a "direction re: title", this transitional provision will not apply. Note, the land must not be conveyed to any foreign entity or taxable trustee other than a purchaser or assignee (and their spouse, if applicable) as stated under the agreement of purchase and sale or assignment entered into on or after March 30, 2022, but on or before October 24, 2022. The NRST rate is 20 per cent on a conveyance of land anywhere in Ontario made pursuant to an agreement of purchase and sale or an assignment of an agreement of purchase and sale that was entered into on or after March 30, 2022, but on or before October 24, 2022. Transitional Provisions for the 20 Per Cent NRST Rate The map of the GGH and a listing of municipalities, counties and regions within the GGH is outlined below on this page. Prior to March 30, 2022, the NRST was a 15 per cent tax on the purchase of an interest in residential property in the Greater Golden Horseshoe Region ( GGH) of Ontario by individuals who are foreign nationals or by foreign corporations or taxable trustees. The NRST applies in addition to the general Land Transfer Tax ( LTT) in Ontario.įrom Mato October 24, 2022, (inclusive) the NRST rate was 20 per cent applied on the purchase or acquisition of an interest in residential property located anywhere in Ontario by individuals who are foreign nationals or by foreign corporations or taxable trustees. The NRST applies on the purchase or acquisition of an interest in residential property located anywhere in Ontario by individuals who are foreign nationals (individuals who are not Canadian citizens or permanent residents of Canada) or by foreign corporations or taxable trustees. Tab to close the table of contents and return to the book.Įffective October 25, 2022, the Non-Resident Speculation Tax ( NRST) rate was increased to 25 per cent.

Land Transfer Tax - Additional Information Collection.Prescribed Information for the Purposes of Section 5.0.1 Form.Land Transfer Tax Exemption For Certain Conveyances of Mineral Lands.

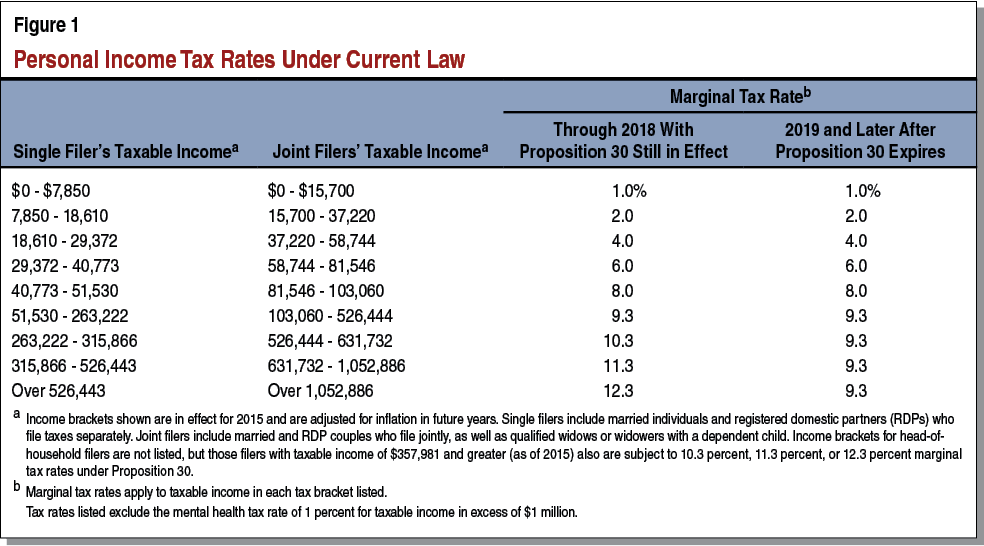

CA STATE INCOME TAX BRACKETS 2020 REGISTRATION

A Guide for Real Estate Practitioners - Land Transfer Tax and the Electronic Registration of Conveyances of Land in Ontario.A Guide for Real Estate Practitioners ‑ Land Transfer Tax and the Registration of Conveyances of Land in Ontario.Guide to the Requirements to Evidence NIL Value of Consideration for Conveyances Involving Trusts - Land Transfer Tax Act.Final order of foreclosure and Quitclaims in Lieu of Foreclosures.Guide to the Application of the Land Transfer Tax Act to Certain Transactions.Effect of the Harmonized Sales Tax on the Value of the Consideration.

0 kommentar(er)

0 kommentar(er)